By Evan Fowler

Almost 400 years ago the Dutch were really excited about tulips. In a period of three years, a tulip bulb went from a reasonable value to as much as six times the average person’s annual salary. Today we look at Dutch people selling their homes to buy tulips as crazy (we literally call that bubble “Tulip Mania”). Yet, right now we are watching South Koreans sell their homes to buy a digital “currency” – Bitcoin.

Everyone is talking about Bitcoin these days. “In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending,” Warren Buffet said during a Wednesday morning interview on CNBC’s “Squak Box.” Yet, Jamie Dimon, the JPMorgan Chase & Co. CEO, who earlier called the cryptocurrency a “fraud,” said last Tuesday: “I regret making” those comments “[t]he blockchain is real. You can have crypto yen and dollars and stuff like that.” These guys are both well known for their financial acumen, but are they disagreeing with each other? Probably not.

Cryptocurrencies change in value quickly and dramatically. Between the time this post was written (January 10, 2018) and posted (January 18, 2018), the following cryptocurrencies fluctuated in value significantly. In January 2017, one Bitcoin was worth about $1,000. Then, in December 2017, Bitcoin reached an all-time high of nearly $20,000, but has since dropped about 30% to $13,500 (40% to $11,825) where it is today. The “market cap” of Bitcoin ( the value of all Bitcoin coins combined) is $227 billion ($190 billion). Bitcoin isn’t the only cryptocurrency spiking and dropping in value. On December 4, 2017, Ripple’s XRP token was worth $0.23, but it achieved a $3.00 valuation on January 3, 2018. However, XRP too has since dropped about 40% to $1.73 (56% to $1.31) where it is today. Ripple’s XRP has a market cap of $67 billion ($51 billion). On December 4, 2017 Ether was worth about $450, today it is at about $1200 ($1000) – will it go up or down?

Cryptocurrency prices have been on a wild ride since the beginning of last year. Many individuals have made millions, and temporarily even billions. Cryptocurrencies are obviously a big deal, but, what are cryptocurrencies, technically? How do we classify them, legally? And how, if at all, are they regulated?

What are cryptocurrencies?

The “cryptocurrencies” that we’re looking at in this piece are built on blockchain technology. Blockchain is a decentralized peer-to-peer network where each participant maintains a replica of a shared append-only ledger of digitally signed transactions. The replicas are kept in sync through a protocol referred to as consensus. In theory, blockchain guarantees the immutability of the ledger, even when some network participants are faulty or even malicious. In other words, blockchain is a networked database that is distributed among each user, instantly updates, and maintains permanent records of all transactions conducted in the network – this is also referred to as distributed ledger technology. Blockchain technology is a big deal because it reduces transaction costs significantly. There are two general modes of blockchain: permissioned (private) and permissionless (public).

Bitcoin uses public blockchain, and Ripple uses private blockchain. There are disagreements as to whether private blockchain really is blockchain, but this piece doesn’t attempt to resolve that debate. Public and private blockchains are distinguished by who is allowed to participate in the network, execute the consensus protocol addressed above, and maintain the shared ledger. A private blockchain requires an invitation and must be validated by either the network founder or by a set of rules put in place by the founder. A public blockchain is completely open, anyone can join and participate. Generally, public blockchains are more energy intensive, have stronger consensus protocols, and provide little to no privacy concerning transactions. There are plenty of commercial applications (financial transactions, medical records, shipment of goods etc.) where the counter-parties to transactions prefer their transactions to remain private and not visible to the general network. [permissioned blockchain technology raises less regulatory concerns because it is more akin to an internal networked database. Check out IBM’s Hyperledger and Chain.]

How do we classify them legally?

In the United States, cryptocurrencies are not considered currency; they’re classified as property. The IRS addressed the taxation of virtual currency transactions in Notice 2014-21. Virtual currency is treated as property for federal tax purposes; general rules for property transactions apply. U.S. regulators (the Commodity Futures Trading Commission “CFTC,” and the Securities and Exchange Commission “SEC”) have generally classified bitcoin and other cryptographic assets as commodities. It is important to note, however, that these “cryptocurrencies” are traded internationally, and each country has its own rules. For example, in September 2017, China shut down a variety of cryptocurrency exchanges. Further, South Korea is pushing for deeper collaboration with Japan and China to regulate cryptocurrencies. It seems that regulation is the newest frontier for these crypto-assets.

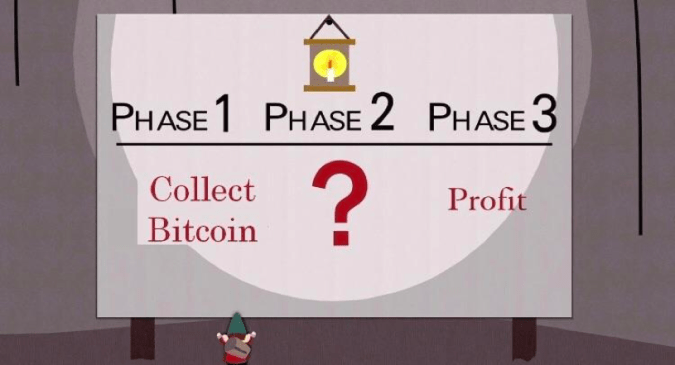

The regulatory framework of cryptocurrency is a mess, in part because people are still confused and the space is developing rapidly. There has been confusion as to whether ICOs produced securities (an ICO is like an IPO) and the SEC does not always agree with the CFTC. It appears that when the dust settles, crypto-assets will most likely be classified as commodities. Aside from debating as to whether crypto-assets are commodities, new and exciting headaches for regulators, like trading futures or establishing crypto-ETFs, are popping up. U.S. financial firms CME Group, CBOE, and Cantor Fitzgerald listed financial products offering exposure (and futures) to cryptocurrencies on December 18, 2017. Just days ago, on January 8, 2018 two U.S. companies shelved proposals to launch bitcoin ETFs because the SEC expressed liquidity concerns. The CFTC has a website devoted to just bitcoin, and likely they’ll expand it to other blockchain based assets.

The Senate’s financial services panel will hold a hearing in February 2018 with market regulators to discuss the risks cryptocurrencies pose to the financial system – hopefully this hearing will give us a better understanding as to what future crypto-regulation will look like. In the meantime, it is very difficult to determine whether all your friends telling you to invest in Bitcoin, Litecoin, Ether, and XRP are giving you good advice. Likely, they’re not giving you good advice, and the Oracle of Omaha’s prediction is one to consider.